1. What is the interest rate ceiling on credit card loans?

A: Credit card companies may charge interest or finance charge up to a maximum of 24 percent annually or a monthly interest rate of up to 2 percent on all credit card transactions. This means that the interest or finance charge which shall be imposed by a bank/credit card issuer on the unpaid outstanding credit card balance of a cardholder as of 03 November 2020 and periods thereafter should not exceed 2 percent per month, unless otherwise revised by the BSP. A separate ceiling is also imposed on the interest that is charged for credit card installment loans. The monthly add-on rate which is used to derive interest on credit card installment loans should not exceed 1 percent per month.

2. What are credit card installment loans?

A: Credit card installment loans are credit card availments that are payable under an installment arrangement.

3. What is the monthly add-on rate?

A: The monthly add-on rate is the interest rate that is charged to cardholders who avail of credit card installment loans. The monthly amortizations that cardholders commit to paying over the term of the installment loan include a principal and an interest component. The interest component of the monthly amortization is derived based on the monthly add-on rate. It is this monthly add-on rate which should not exceed 1 percent per month. The monthly add-on rate only applies to credit card installment loans and is different from the monthly interest rate or finance charge which is imposed on unpaid outstanding credit card balance.

4. What are finance charges?

A: Finance charges refer to the interest charged to the cardholder on all credit card transactions in accordance with the terms and conditions specified in the contract/agreement on the use of the credit card.

5. What comprises a cardholder’s unpaid outstanding credit card balance?

A: The unpaid outstanding credit card balance of a cardholder refers to amounts of the following transactions that remain unpaid on the payment due date:

a. Purchases made during the previous credit card statement cycle,

b. Credit card cash advances or monthly installment of credit card cash advances in case the same is payable in installments,

c. Monthly installment payments that are due as of the statement cut-off date, and

d. Interest, finance charges or other fees and charges.

6. When does a cardholder incur an unpaid outstanding credit card balance?

A: An unpaid outstanding credit card balance occurs if a cardholder pays less than or does not pay on or before the payment due date, the outstanding credit card balance as of the statement date stated in his/her statement of account.

7. Will a credit cardholder who pays the minimum amount due still be subject to interest or finance charges?

A: Yes. Interest or finance charges will be imposed on the unpaid outstanding credit card balance of the cardholder.

Banks/Credit card issuers require a cardholder to pay a minimum amount on each statement date to avoid the imposition of late payment charges and keep the account from being considered as in default.

The minimum amount due is normally the sum of the following:

a. outstanding balance multiplied by the required payment percentage, or a fixed amount, whichever is higher,

b. any amount which is part of any fixed monthly installment that is charged to the credit card,

c. any amount in excess of the cardholder’s credit line, and

d. all past due amounts, if any.

8. Are other credit card fees and charges subject to a cap, too?

A: Only the upfront processing fees charged upon availment of credit card cash advances is subject to a cap of P200 per transaction. No other upfront fees may be imposed or collected upon the availment of credit card cash advances apart from this processing fee.

9. Does the interest rate ceiling and cap on the processing fees for credit card cash advances cover domestic and foreign transactions on locally issued credit cards?

A: Yes. The interest rate ceiling and the cap on the processing fees that are charged upon availment of credit card cash advances provided under Circular No. 1098 apply to both domestic and foreign transactions charged on credit cards issued by banks/credit card issuers.

10. Why did the BSP impose an interest rate ceiling on credit card transactions?

A: The imposition of a ceiling on interest or finance charges on all credit card transactions is pursuant to the BSP’s supervisory authority over banks/credit card issuers under the Philippine Credit Card Industry Regulation Law. The provisions of the Philippine Credit Card Industry Regulation Law explicitly provide that the BSP’s supervisory authority includes the determination of the reasonableness of fees and charges for credit card transactions and the issuance of regulations on the same.

Based on the BSP’s assessment, the credit card interest or finance charges in the Philippines are relatively high compared with our ASEAN neighbors. Similar to the Philippines, two ASEAN countries, Malaysia and Thailand, have an existing interest rate ceiling on credit card loans. Banks/Credit card issuers in the Philippines, however, have been noted to adjust the interest rates or finance charges imposed on credit card transactions during the onset of the pandemic in the first half of 2020.

The setting of the ceiling on interest or finance charges also promotes responsible credit card lending in the country. It is in accordance with the core principle of fair treatment which all BSP-supervised financial institutions are expected to observe in dealing with financial consumers, especially under current exceptional circumstances.

The ceiling on interest or finance charges aims to ease the financial burden of consumers, including micro-, small- and medium business enterprises amid a challenging operating environment caused by the COVID-19 pandemic.

The policy forms part of the BSP’s regulatory framework governing credit card transactions. Under the BSP’s guidelines, banks/credit card issuers are subject to standards of good governance, adequate risk management, and strong consumer protection mechanisms.

11. How did the BSP arrive at an interest rate ceiling of 24 percent?

A: The determination of an interest rate ceiling is based on a study which examined the presence of risk-based pricing in credit card receivables. The results of the study were complemented by an analysis of the behavior of bank lending rates, including interest rates on credit card receivables, review of practices in other jurisdictions as well as consultations with the banking and credit card industry.

The maximum annual interest rate or finance charge of 24 percent or monthly interest rate of 2 percent for credit card transactions as well as the maximum monthly add-on rate of 1 percent for credit card installment loans generally approximate the interest or finance charges currently imposed by the industry. As of 30 June 2020, the average annual interest rate or finance charge imposed by banks on credit card transactions ranged between 18.9 percent and 32.8 percent, based on information obtained from the Credit Card Business Activity Report of banks/credit card issuers.

The ceiling on interest rate is also in keeping with the country’s current low interest rate environment. The interest rate on the BSP’s overnight reverse repurchase (RRP) facility, which is a benchmark for cost of borrowing for banks, has declined since 2019 and settled at 2.25 percent in October 2020.

In view of the foregoing, the BSP has determined that there is room to adjust credit card interest rates or finance charges to keep this in line with current operating developments. Going forward, this interest rate ceiling of 24 percent will be reviewed regularly by the BSP.

APPLICATION OF THE CEILING ON INTEREST RATES, FINANCE CHARGES AND FEES

12. When is the ceiling on interest rates, finance charges and fees effective?

A: The ceiling on interest rates, finance charges and fees will take effect on 03 November 2020.

This means that unpaid outstanding credit card balance of cardholders as of 3 November 2020 and, periods thereafter, shall be charged an interest rate of up to 2 percent per month, unless otherwise revised by the BSP.

Meanwhile, the ceiling on the monthly add-on rate for credit card installment loans of up to 1 percent shall only apply to credit card installment loans that are availed on or after 3 November 2020, unless otherwise revised by the BSP.

The cap on the processing fees that are imposed on the grant of credit card cash advances of up to P200 shall only apply to credit card cash advances that are availed on or after 3 November 2020, unless otherwise revised by the BSP.

13. Are my existing credit card installment loans covered by the ceiling on the monthly add-on rate of 1 percent?

A: No. Only credit card installment loans that are availed on or after 03 November 2020 shall be subject to the 1 percent ceiling on the monthly add-on rate unless otherwise revised by the BSP.

14. What is the basis for the computation of interest or finance charges?

A: Interest or finance charges may be imposed on the unpaid outstanding credit card balance as of statement cut-off date excluding:

a. the current billing cycle’s purchase transactions reckoned from the previous cycle’s statement cut-off date; and

b. deferred payments under zero-interest installment arrangements which are not yet due.

For credit card cash advances, a cardholder may be charged cash advance processing fees and interest/finance charge on the date that the cash is obtained, subject to terms and conditions under the credit card contract/agreement.

For a loan where the principal is payable in installments, interest per installment period shall be calculated based on the outstanding balance of the loan at the beginning of each installment period.

15. For how long will the ceiling on credit card interest rates, finance charges and fees be in effect?

A: The ceiling on credit card interest rates, finance charges and fees are subject to review by the BSP every six (6) months. Adjustments or changes, if any, to this ceiling will be made as a result of the six-month review.

16. Do I need to request for repricing of my outstanding loans with my credit card company to be entitled to the ceiling on interest rate or finance charge?

A: No. The ceiling on credit card interest rate or finance charges and processing fees will automatically take effect on 3 November 2020.

17. How will the interest rate or finance charge ceiling and processing fee cap work with the Bayanihan to Recover as One Act (Bayanihan II)?

A: The interest rate or finance charge ceiling and processing fee cap introduced under BSP Circular No. 1098 dated 24 September 2020 are imposed independently and in addition to relief measures granted to borrowers under the Bayanihan II and Bayanihan to Heal as One Act. Credit cardholders who availed of the grace period under the Bayanihan II may also benefit from the ceiling provided under BSP Circular No. 1098.

ILLUSTRATIVE EXAMPLES

18. How will the 24 percent ceiling on interest rates or finance charges be implemented upon the effectivity of the Circular in the example provided below?

Basic credit card information:

Statement Date: 6 November 2020

Payment Due Date: 24 November 2020

Interest or Finance Charge prior to ceiling: 3.5% per month

Interest or Finance Charge effective 3 November 2020: 2% per month Daily interest is determined by dividing monthly interest rate by 30 days

Credit card obligations:

Outstanding credit card obligation of P10,000 as of 31 October 2020. Minimum amount due on 24 November 2020 is P1,000.

Total amount due on 24 November is P10,000.

Credit card transactions:

Retail purchase made on 20 November 2020 amounting to P5,000. Cardholder paid P2,000 on 24 November 2020.

a. How much is the unpaid outstanding credit card balance that will be subject to interest or finance charges?

The unpaid outstanding credit card balance that will be subject to interest or finance charges is as follows:

From 1 to 23 November 2020, the unpaid outstanding credit card balance that will be charged daily interest or finance charge is P10,000.

From 24 to 30 November, the unpaid outstanding credit card balance that will be charged daily interest or finance charge is P8,000 (P10,000 less P2,000 payment).

The retail purchase made after the statement date should not be charged interest or finance charge during the month of November 2020 since this is a purchase that is made during the cardholder’s current billing cycle.

b. How much is the maximum interest or finance charge that can be charged on the transaction?

In computing for the interest or finance charge, the daily interest rate is multiplied by the unpaid outstanding credit card balance at the end of the day. The new monthly interest or finance charge upon effectivity of the Circular will be applied on the unpaid outstanding credit card balance as of 3 November 2020, and periods thereafter, unless otherwise revised by the BSP.

In the example, the interest or finance charge on the credit card transaction will be as follows:

Interest or finance charge for 1 to 2 November

= .035/30 x 2 days x p10,000

= P23.33

Interest or finance charge for 3 to 23 November

= .02/30 x 21 days x P10,000

= P140.00

Interest or finance charge for 24 to 30 November

= .02/30 x 7 days x P8,000

= P37.33

Total Interest or Finance Charge from 1-30 November 2020 = P200.66

c. What if the cardholder chooses to pay the total amount due of P10,000 on payment due date? Will interest or finance charge still be charged on the credit card transaction?

Interest or finance charge should not be charged in this instance since the borrower paid his/her total outstanding balance as of statement date on or before the payment due date.

19. How will the 24 percent ceiling on interest rates or finance charges be implemented upon effectivity of the Circular in the example provided below?

Basic credit card information:

Statement Date: 6 November 2020

Payment Due Date: 24 November 2020

Interest or Finance Charge prior to ceiling: 3.5% per month

Interest or Finance Charge effective 3 November 2020: 2% per month Daily interest is determined by dividing monthly interest rate by 30 days Processing Fee on the Grant of Cash Advances: P150/availment

Credit card obligations:

Outstanding credit card obligation of P10,000 as of 31 October 2020. Minimum amount due on 24 November 2020 is P5,000.

Total amount due on 24 November is P25,150.

Credit card transactions:

Credit card cash advance made on 1 November 2020 amounting to P15,000. Cardholder paid P10,000 on 24 November 2020.

a. How much is the unpaid outstanding credit card balance that will be subject to interest or finance charges?

The unpaid outstanding credit card balance that will be subject to interest or finance charges is as follows:

From 1 to 23 November 2020, the unpaid outstanding credit card balance that will be charged daily interest or finance charge is P25,150 (P10,000 + P15,000 + P150).

From 24 to 30 November, the unpaid outstanding credit card balance that will be charged daily interest or finance charge is P15,150 (P25,150 less P10,000 payment).

The amount of the credit card cash advance and the processing fee will form part of the cardholder’s total outstanding credit card balance as of statement due date.

b. How much is the maximum interest or finance charge that can be charged on the transaction?

In computing for the interest or finance charge, the daily interest rate is multiplied by the unpaid outstanding credit card balance at the end of the day. The new monthly interest or finance charge upon effectivity of the Circular will be applied on the unpaid outstanding credit card balance as of 3 November 2020, and periods thereafter, unless otherwise revised by the BSP.

In the example, the interest or finance charge on the credit card transaction will be as follows:

Interest or finance charge for L to 2 November

= .035/30 x 2 days x p25,150

= P58.58

lnterest or finance charge for 3 to 23 November

= .02/30 x 21 days x p25,150

= P352.10

fnterest orfinance charge for24to 30 November

= .02/30 x 7 days x p15,150

= P70.70

Total lnterest or Finance Charge from 1-30 November 2020 = P481.48

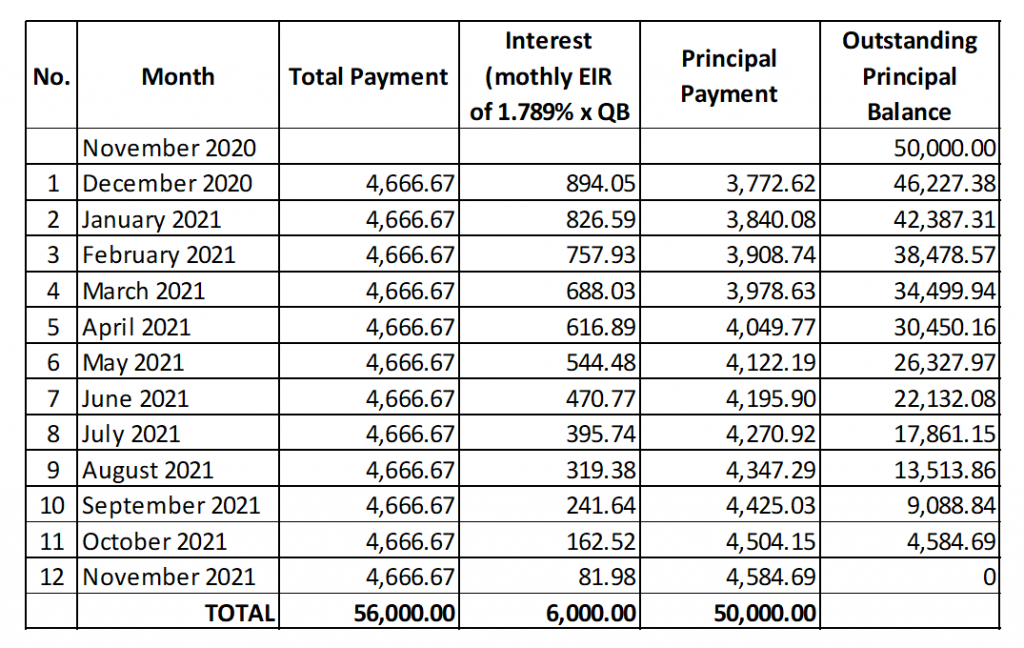

20. How will the ceiling on the monthly add-on rate for credit card installment loans be implemented upon effectivity of the Circular in the example provided below?

A: A cardholder purchases an appliance costing P50,000 on 3 November 2020 payable on installment over a 12-month period. The monthly add-on rate charged by the bank/credit card issuer on the transaction is 1 percent per month.

The bank/credit card issuer requires cardholders to pay a minimum amount equivalent to 5 percent of the total amount due (excluding fixed monthly installments) plus fixed monthly amortization due on credit card installment loans, if any.

a. How much will the cardholder pay every month on his credit card installment loan?

The monthly add-on rate of 1 percent is the interest that is charged on the credit card installment loan.

In the example, the cardholder will be required to make monthly payments amounting to P4,667.67 which is derived by applying a factor rate of 0.0933* to the financing amount of P50,000. The monthly payment of P4,667.00 includes interest component.

Monthly interest is computed by multiplying the monthly effective interest rate** to the outstanding balance of the loan at the beginning of the installment period.

Note: Figures may vary due to rounding off.

*The factor rate is computed as (Rate x Term +1) / Term = (0.01 x 12) +1 / 12

**The monthly effective interest rate is the rate of interest that exactly discounts estimated future monthly cash flows through the life of the loan to the net amount of loan proceeds. Upfront fees (processing and disbursement fees) that are deducted from loan proceeds are considered in the determination of the monthly effective interest rate.

21. A cardholder has an outstanding credit card installment loan as of 3 November 2020 which was availed on 3 September 2020 with remaining installment term of 4 months and fixed monthly amortization of P5,000. The said outstanding credit card installment loan was charged a monthly add-on rate of 1.5 percent at the time of availment. The bank/credit card issuer requires cardholders to pay a minimum amount equivalent to 5 percent of total amount due (excluding fixed monthly installments) plus fixed monthly amortization due on credit card installment loans, if any.

a. Should the monthly add-on rate of such outstanding credit card installment loan be adjusted to comply with the 1 percent ceiling which will take effect on 3 November 2020?

A. No. The bank/credit card issuer is not obliged to adjust the monthly add-on rate as well as the monthly installment payments on a credit card installment loan which was availed prior to 3 November 2020 in order to comply with the interest rate ceiling prescribed by the BSP.

b. Assuming the credit card borrower has no other credit card transaction apart from the credit card installment loan, what would happen if the credit card borrower fails to pay the fixed monthly amortization of P5,000 in December 2020?

A. Failure by the cardholder to pay the monthly installment of P5,000 in December 2020 would subject the unpaid monthly installment amount to interest or finance charges which should not exceed the monthly interest rate of 2 percent per month.

The credit card account may also be considered as delinquent and subject to additional late payment charges, and other charges, as specified in the Terms and Conditions on the use of the credit card.

c. Would the credit cardholder still be able to request for repricing or restructuring of his credit card installment loan?

A. Yes. The credit cardholder may coordinate with his/her bank/credit card issuer and request for the adoption of a modified payment plan on his outstanding credit card installment loan that would match his/her payment capacity, if necessary.

d. Assuming the credit card borrower wishes to pay his/her loan in full after paying 3 of 12 amortizations payments. Should he/she be obliged to pay the monthly add-on rate for the 9 remaining amortizations?

A. The credit cardholder will have to coordinate with his/her bank/credit card issuer in this situation since this will depend on the terms and conditions of the credit card installment loan.

22. What will happen if the cardholder is unable to pay the monthly installment due on a credit card installment loan or before the statement due date?

A. Unpaid monthly installment amortizations billed from prior statement cut-off date are included in the computation of the cardholder’s outstanding credit balance. If this balance is unpaid as of due date, additional interest or finance charges, which should not exceed an annual interest rate of 24 percent or monthly interest rate of 2 percent, will be imposed on the unpaid monthly installment.

23. What do I do if I need clarification on the computation of fees and charges on my credit card statement?

A. The cardholder should communicate with his/her bank/credit card issuer on the computation of interest or finance charges as well as fees. Should the cardholder’s concerns remain unaddressed, he/she may escalate his/her concerns to the BSP via e-mail to consumeraffairs@bsp.gov.ph or to the BSP Online Buddy (BOB).

BOB may be accessed through the following:

- BSP Webchat – http://www.bsp.gov.ph/

- SMS — 21582277 (for Globe subscribers only; for other network subscribers, BOB will also be made available soon)

- BSP Facebook – https://www.facebook.com/BangkoSentraIngPilipinas/

Equicom Savings Bank is regulated by the Bangko Sentral ng Pilipinas (BSP) with contact number (632) 8708-7087 and email address consumeraffairs@bsp.gov.ph.